Step 1

Accurate Valuation

The achievable rental value of your property is determined by many factors including its location, services and amenities nearby, the cosmetic appearance and condition of the property and number of bedrooms.

In addition, market forces play a large part in dictating the asking price of the property. Rosking will advise you on a realistic achievable rental valuation taking into consideration everything detailed here, and the price you are expecting. Be mindful of the fact that over-valuing the property can put off potential tenants, leaving you with an empty property and no income.

Step 2

HMO Or Not An HMO?

An HMO (House in Multiple Occupancy) occurs when several unrelated people share a house. This is a very grey area but can cause a great deal of aggravation if not dealt with properly, and worst case scenario you could end up with a financial penalty and a very hefty bill to put it right.

Put simply if your property is on 3 or more levels and let to 5 or more tenants comprising 2 or more households (i.e. not all of the same family) it will be subject to mandatory licensing by your local authority. Whether mandatory licensing applies or not, if there are 3 or more tenants not all related in any property, it is still likely to be an HMO, and special Management rules apply. Ask us or contact your local authority for details.

Step 3

Consider Property Management

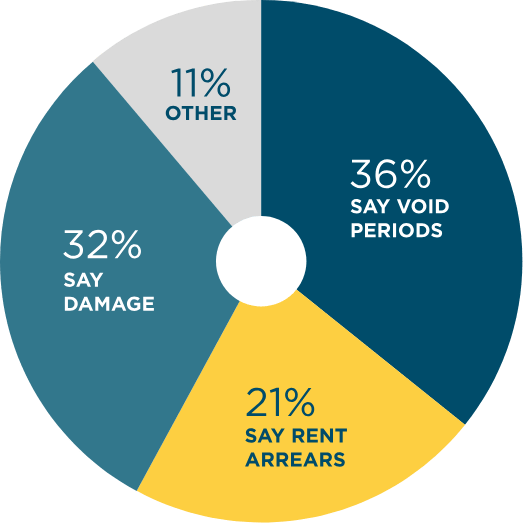

Looking after a rented property is fine when it’s all going according to plan. Your tenants seem like nice people, pay their rent on time, never phone you moaning about changing a lightbulb at 3am, and leave the property on time, leaving it nicely cleaned and all intact.

However, when things go wrong it can get overwhelming, and can cause a great deal of problems, both legal and financial. Let us take the strain and manage your property for you. That way, you can ensure that you’re protected in every way and we’ll work hard to make sure you’re not out of pocket financially or legally on thin ice.

Read MoreConsider Property Management

Looking after a rented property is fine when it’s all going according to plan. Your tenants seem like nice people, pay their rent on time, never phone you moaning about changing a lightbulb at 3am, and leave the property on time, leaving it nicely cleaned and all intact. However, when things go wrong it can get overwhelming, and can cause a great deal of problems, both legal and financial.

Let us take the strain and manage your property for you. That way, you can ensure that you’re protected in every way and we’ll work hard to make sure you’re not out of pocket financially or legally on thin ice. We’re proud of our knowledge of the industry and will always act in your best interests at all times. We’ll even renew your Landlords Gas Safety certificate automatically. Our full management service includes the following:

Free Property Appraisal to make sure we get it marketed at the right price.

Good quality photos and floor plans

Advertising on all major portals inc. Rightmove, On The Market, Zoopla etc.

Carrying out accompanied viewings

Full background and credit checks, guarantor referencing, employer and earnings validation, immigration and Right to Live checks and previous landlord reference checking on all potential tenants.

Logging of deposits

Drafting and signing of Assured Shorthold Tenancy Agreements

Arranging independent photographic Inventory

Arranging end of tenancy cleans

Arranging EPC and Landlords Gas Safety Record where required

Advising on adherence to current rental property legislation

Check-in Service For the new tenants

Collection and payment of rent (less fees and other payments as agreed)

Check-out Service

Regular property inspections and full written follow up report

Full management of maintenance issues

Rent collection and onward payment

Automatic renewal of Landlords Gas Safety Record (where applicable)

Chasing arrears

Service of Notices

Preparation of court paperwork and eviction handling (when required)

Step 4

Accurate Valuation

There are several things to consider when renting a property. Avoid bright garish colours on walls, keep the garden simple and laid to lawn where possible, and remove all personal items. Find all window and door keys, ensure that all locks work effectively.

If the property was your home, arrange for your mail to be forwarded. Decide what you are going to leave there and what you want to take away, and make all minor repairs.

Read MoreAccurate Valuation

There are several things to consider when renting a property. Avoid bright garish colours on walls, keep the garden simple and laid to lawn where possible, and remove all personal items. Find all window and door keys, ensure that all locks work effectively.

If the property was your home, arrange for your mail to be forwarded. Decide what you are going to leave there and what you want to take away, and make all minor repairs. Several things to consider before you even put the property on the market:

Mortgage – If your property is mortgaged you’ll need permission from your lender.

Leasehold properties - If the property is leasehold you’ll also need to check the Head lease for any special terms or conditions, and seek permission from the Freeholder if necessary

Insurance – Ensure that Landlords insurance is in place

Tax – Income tax is payable on rental properties and it is the Landlords responsibility to de clare that income to HM Revenue & Customs.

For overseas Landlords, you will need toapply to HMRC for an exemption certificate which we need to see in order for us to pay rent

without deducting tax.

More information on UK and non-resident tax liability can be found at www.hmrc.gov.uk

For any rental property, you need to consider:

The Gas Safety Certificate (Installation and use) Regulations 1994

Any rental property must have all gas appliances and installations tested by a Gas Safe qualified engineer on an annual basis, and this needs to be in place before any tenants move in. A copy of the valid Gas Safety Certificate must be given to the tenant(s) before the start of their tenancy. If there is no valid certificate then we can help in this matter, at the landlord’s expense. Failure to provide or maintain a valid Landlords Gas Safety certificate could lead to up to 6 months imprisonment and or a very hefty fine.

The Electrical (Safety) Regulations 1994 / Plugs and Sockets (Safety) Regulations 1994

It is a criminal offence to rent properties without safe electrical equipment. Landlords must make sure that ALL electrical equipment, appliances and electrical supply is safe. Electrical items must be examined by a qualified electrician before the tenancy commences. If you wish, we can instruct an approved contractor to carry out this check.

The Furniture and Furnishings (Fire and Safety) Regulations 1988

If you intend to provide your property furnished, you must make sure that all soft furnishings or upholstered furniture complies with the Furniture and Furnishings act. You don’t need a certificate for this.

Energy Performance Certificate

Energy Performance Certificates (EPCs) give information on how to make your home more energy efficient and reduce your energy costs. All rental properties require an EPC, and the values need to be displayed on all adverts. A copy of the EPC is given to all tenants at the start of the tenancy as part of the welcome pack.

Step 5

Preparing Your Property For Tenancy

Decide whether to let your property furnished or unfurnished. Furnished properties will give a better visual impression to the prospective tenants on how the property will look, making it more likely to rent quicker.

If the quality of the furniture warrants it, you can charge a premium rental price than if it was unfurnished. However the down side is that offering the property furnished will increase costs over time as wear and tear necessitate replacing the furniture.

Read MorePreparing Your Property For Tenancy

Decide whether to let your property furnished or unfurnished. Furnished properties will give a better visual impression to the prospective tenants on how the property will look, making it more likely to rent quicker.

If the quality of the furniture warrants it, you can charge a premium rental price than if it was unfurnished. However, the downside is that offering the property furnished will increase costs over time as wear and tear necessitate replacing the furniture.

Leasehold properties - If the property is leasehold you’ll also need to check the Head lease for any special terms or conditions, and seek permission from the Freeholder if necessary

We recommend that the landlord provides white goods as a minimum (washing machine, cooker and fridge freezer) if letting the property unfurnished. Flexibility is key as this will broaden the appeal of the property to prospective tenants as individual requirements vary. Anything surplus to requirements should be removed and placed into storage if need be.